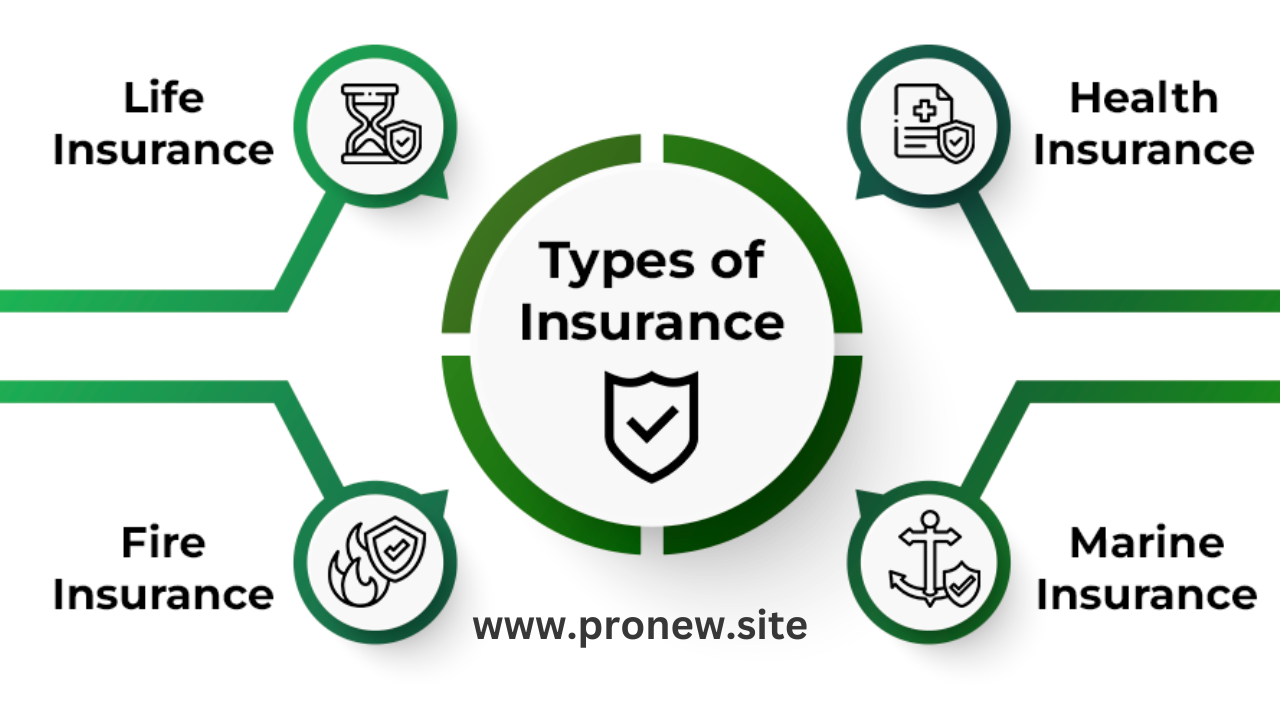

Understanding Different Types of Insurance: A Comprehensive Guide

Insurance is a vital component of financial planning, providing protection and peace of mind against unexpected events. In today’s complex world, understanding the various types of insurance available is crucial for safeguarding yourself, your family, and your assets. This guide explores the most common types of insurance, their benefits, and key considerations to help you make informed decisions.

1. Health Insurance

Overview: Health insurance covers medical expenses, including doctor visits, hospital stays, surgeries, and prescription medications. It helps manage the cost of healthcare, reducing the financial burden on individuals and families.

Types:

- Individual Health Insurance: Purchased by individuals or families directly from insurance providers.

- Group Health Insurance: Offered through employers or organizations, often with more favorable terms due to the collective bargaining power.

- Government Programs: Medicaid and Medicare provide coverage for eligible low-income individuals and seniors, respectively.

Benefits:

- Reduces out-of-pocket expenses for medical care.

- Provides access to a network of healthcare providers.

- Includes preventive services, reducing long-term health risks.

Considerations:

- Premiums, deductibles, and co-pays vary; choose a plan that fits your financial situation and healthcare needs.

- Review the network of doctors and hospitals to ensure they align with your preferences.

2. Life Insurance

Overview: Life insurance provides financial support to beneficiaries in the event of the policyholder’s death. It ensures that loved ones are financially secure and can cover expenses such as funeral costs and outstanding debts.

Types:

- Term Life Insurance: Provides coverage for a specified period (e.g., 10, 20, or 30 years). It is generally more affordable but offers no cash value accumulation.

- Whole Life Insurance: Offers lifetime coverage with a savings component that builds cash value over time.

- Universal Life Insurance: Flexible premiums and coverage amounts with an investment component.

Benefits:

- Provides financial security for dependents and beneficiaries.

- Can be used to cover debts, estate taxes, and future expenses.

- Whole and universal policies accumulate cash value, which can be borrowed against or used to pay premiums.

Considerations:

- Determine the amount of coverage needed based on financial obligations and future needs.

- Compare policy terms, including premiums and benefits, to find the best fit for your situation.

3. Auto Insurance

Overview: Auto insurance protects against financial loss due to accidents, theft, or damage involving a vehicle. It is required by law in most places and provides coverage for both liability and physical damage.

Types:

- Liability Insurance: Covers damages and injuries to others if you are at fault in an accident.

- Collision Insurance: Covers damage to your own vehicle from a collision.

- Comprehensive Insurance: Covers non-collision-related damage (e.g., theft, vandalism, natural disasters).

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re in an accident with someone who has insufficient insurance.

Benefits:

- Provides financial protection against expensive repairs and medical costs.

- Meets legal requirements for vehicle ownership.

- Offers peace of mind while driving.

Considerations:

- State requirements vary; ensure you meet local minimum coverage levels.

- Consider factors such as your driving history, vehicle value, and budget when choosing coverage levels.

4. Homeowners Insurance

Overview: Homeowners insurance protects your home and personal property against damage or loss due to events like fire, theft, or natural disasters. It also provides liability coverage in case someone is injured on your property.

Types:

- HO-1 (Basic Form): Covers specific perils such as fire, theft, and vandalism.

- HO-2 (Broad Form): Offers more comprehensive coverage, including additional perils.

- HO-3 (Special Form): Provides open-peril coverage for the home and named-peril coverage for personal property.

- HO-5 (Comprehensive Form): Offers the broadest coverage for both the home and personal belongings.

Benefits:

- Protects your investment in your home and its contents.

- Includes liability protection for accidents on your property.

- May cover additional living expenses if your home becomes uninhabitable.

Considerations:

- Review coverage limits and exclusions; ensure they align with the value of your home and belongings.

- Consider additional coverage for high-value items or specific risks.

5. Renters Insurance

Overview: Renters insurance provides coverage for personal property within a rented residence and liability protection. It is often required by landlords and offers protection similar to homeowners insurance but without the property structure.

Types:

- Basic Coverage: Includes protection against common perils like fire, theft, and vandalism.

- Broad Coverage: Expands to include additional risks.

- Specialty Coverage: May cover specific items or risks not included in standard policies.

Benefits:

- Protects personal belongings from damage or loss.

- Provides liability coverage for accidents that occur in the rented space.

- Often affordable and easy to obtain.

Considerations:

- Assess the value of your personal property to determine appropriate coverage limits.

- Review the policy for exclusions and additional coverage options.

6. Disability Insurance

Overview: Disability insurance provides income replacement if you are unable to work due to illness or injury. It helps cover living expenses when you are temporarily or permanently disabled.

Types:

- Short-Term Disability Insurance: Provides coverage for a limited period, typically up to six months.

- Long-Term Disability Insurance: Offers extended coverage, often until retirement age or for a specified period.

Benefits:

- Ensures financial stability during periods of disability.

- Covers a portion of lost income, reducing financial stress.

- May include rehabilitation or vocational services.

Considerations:

- Review the waiting period and benefit duration to match your needs.

- Consider both employer-provided and individual policies for comprehensive coverage.

7. Travel Insurance

Overview: Travel insurance covers unexpected events during travel, including trip cancellations, medical emergencies, and lost baggage. It offers peace of mind while traveling domestically or internationally.

Types:

- Trip Cancellation Insurance: Reimburses non-refundable expenses if you need to cancel your trip.

- Emergency Medical Insurance: Covers medical expenses incurred while traveling.

- Baggage Insurance: Provides compensation for lost, stolen, or damaged baggage.

Benefits:

- Protects against financial loss due to trip interruptions or cancellations.

- Offers assistance in emergencies while traveling.

- Provides peace of mind during trips.

Considerations:

- Evaluate coverage options based on your travel plans and potential risks.

- Ensure coverage meets the specific needs of your trip and destinations.

8. Pet Insurance

Overview: Pet insurance helps cover veterinary expenses for pets, including accidents, illnesses, and routine care. It can reduce the financial burden of caring for a beloved animal.

Types:

- Accident-Only Coverage: Covers expenses related to accidents, such as injuries or poisonings.

- Comprehensive Coverage: Includes accidents, illnesses, and sometimes routine care and wellness visits.

Benefits:

- Reduces the cost of veterinary care and treatments.

- Provides access to a network of veterinarians and specialists.

- Offers peace of mind for pet owners.

Considerations:

- Review policy details for exclusions and coverage limits.

- Consider the age and health of your pet when choosing a plan.

Conclusion

Insurance is a fundamental aspect of managing risk and protecting your financial well-being. Each type of insurance serves a unique purpose, offering specific benefits and considerations. By understanding the various options available, you can make informed decisions that best meet your needs and provide security for yourself, your family, and your assets.

Choosing the right insurance requires careful evaluation of your personal circumstances, including financial goals, health needs, and risk factors. Regularly reviewing and updating your insurance policies ensures that you maintain adequate coverage as your life and circumstances change. With the right insurance in place, you can navigate life’s uncertainties with confidence and peace of mind.

This article provides a broad overview of essential insurance types, highlighting their importance and considerations. For a more in-depth analysis, each type of insurance can be further expanded with specific examples, case studies, or detailed comparisons.